Budgeting for big expenses like rent, groceries, and utilities is easy. But what about the unexpected costs that sneak up on you? These hidden expenses can strain your finances if you’re not prepared.

From home maintenance surprises to overlooked fees, here are 15 hidden costs everyone should plan for—because nobody likes financial surprises.

1. Home Maintenance and Repairs

Even if your home is brand new, things will break. Water heaters fail, roofs need patching, and HVAC systems require tune-ups. Experts recommend setting aside 1-3% of your home’s value each year for maintenance.

Ignoring small problems can lead to bigger, costlier repairs down the line. A little preventative care goes a long way in saving money.

2. Emergency Medical Expenses

Even with insurance, medical bills can pile up fast. Deductibles, copays, prescriptions, and unexpected emergencies add up quickly.

Having a health savings account (HSA) or emergency fund can keep medical surprises from wrecking your budget.

3. Car Repairs and Maintenance

Oil changes and new tires aren’t cheap, and major repairs like transmission issues can be even worse. Regular maintenance can help prevent expensive breakdowns, but some repairs are unavoidable.

A good rule of thumb: Set aside at least $50-$100 a month for car-related expenses.

4. Subscription Creep

Streaming services, cloud storage, gym memberships, and software subscriptions can quietly drain your bank account. Many people sign up for free trials and forget to cancel.

Review your subscriptions every few months and cut the ones you don’t use. Those small monthly fees add up fast!

5. Inflation and Rising Prices

From groceries to rent, prices are always on the rise. Even if you have a solid budget today, inflation means you’ll likely need to adjust it in the future.

Planning for rising costs helps prevent financial strain when everyday expenses increase.

6. Moving Costs

Even if you’re not planning to move soon, relocation costs can be a shock. Movers, truck rentals, security deposits, and utility setup fees add up quickly.

If you think a move might be in your future, start saving now to avoid scrambling later.

7. Unexpected Travel Costs

Flights get delayed, baggage fees keep increasing, and last-minute trips for family emergencies can be expensive. Travel insurance and a buffer in your budget can help cover surprise travel costs.

8. Pet Emergencies and Vet Bills

Routine vet visits are one thing, but emergency surgeries or chronic health issues can cost thousands. Pet insurance or a dedicated savings fund for your furry friend can save you from tough financial decisions.

9. Higher Utility Bills Than Expected

Seasonal changes, rate increases, and hidden fees can make utility bills fluctuate. If you just moved or started working from home, your costs might be higher than you expect.

Budgeting extra for heating, cooling, and water bills can keep you from getting caught off guard.

10. Tech Replacements and Upgrades

Phones, laptops, and tablets don’t last forever. Whether it’s an upgrade for work or a sudden device failure, tech expenses can be a big hit.

Plan for tech replacements every few years so you’re not scrambling when your laptop dies unexpectedly.

11. Bank Fees and Hidden Charges

Overdraft fees, ATM charges, and account maintenance fees can sneak up on you. Some banks even charge inactivity fees or require minimum balances.

Review your account terms and switch to a fee-free bank if possible.

12. Child-Related Expenses

Kids are expensive beyond just diapers and daycare. Unexpected costs like sports fees, school supplies, birthday parties, and summer camps can add up fast.

Setting aside a little extra for these expenses can help avoid last-minute financial stress.

13. Work-Related Costs

Commuting, work clothes, networking events, and coffee runs add up quickly. If you work remotely, you might still need to pay for a good home office setup, software, or internet upgrades.

Budgeting for work-related expenses ensures you’re not dipping into personal funds for professional needs.

14. Homeowners or Renters Insurance Gaps

Your home or renters insurance might not cover everything you assume it does. Flooding, earthquakes, and high-value items like jewelry often require separate policies.

Check your coverage now to avoid expensive surprises if disaster strikes.

Related: 10 Part-Time Jobs for Retired Dog Lovers

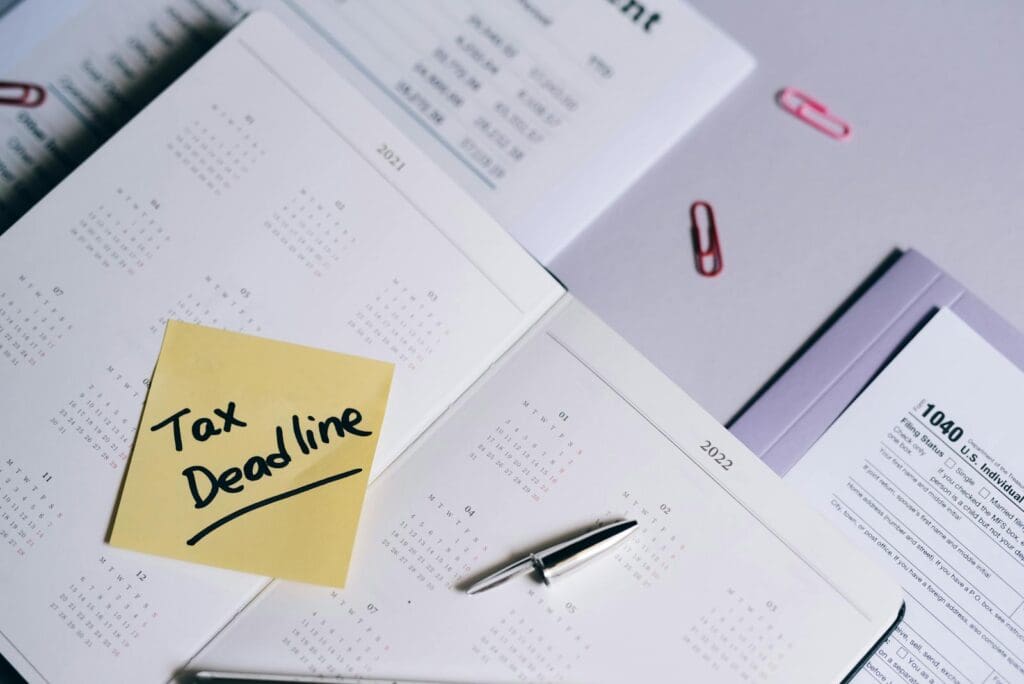

15. Taxes and Unexpected Bills

Many people underestimate their tax bills, especially if they’re self-employed or receive bonuses. Property tax increases and unexpected bills like toll violations or parking tickets can also sneak up on you.

Setting aside a portion of your income for tax surprises can help prevent a financial headache later.

Related: Workplace Perks You Should Be Asking For in 2025